The Three Buckets of Retirement Income: Rethinking Home Equity

For many, paying off a mortgage and owning a home free and clear is seen as the ultimate financial milestone in retirement. Some even delay retirement until their home is fully paid off, believing it provides long-term security. However, while home equity is valuable, it’s not the most efficient form of wealth—because it’s not liquid. In a world where home values fluctuate and long-term care expenses loom, having your wealth tied up in home equity can limit your financial flexibility. Instead, converting home equity into accessible cash can provide greater control over your retirement finances.

Rethinking the “Paid-Off Home” Mindset

The Great Depression and the 2008 housing crisis reinforced the idea that paying off a home is the safest path. While eliminating mortgage payments can be reassuring, it’s not always the most strategic move—especially when a reverse mortgage enters the equation.

With a Home Equity Conversion Mortgage (HECM), homeowners 62 and older can access their home equity without taking on monthly mortgage payments. As long as you live in your home as your primary residence, keep up with property taxes, homeowners insurance, and basic maintenance, there’s no risk of foreclosure due to missed payments. This shifts the traditional thinking—your home is an excellent place to live, but not necessarily the best place to store wealth.

The Three Buckets of Retirement Income

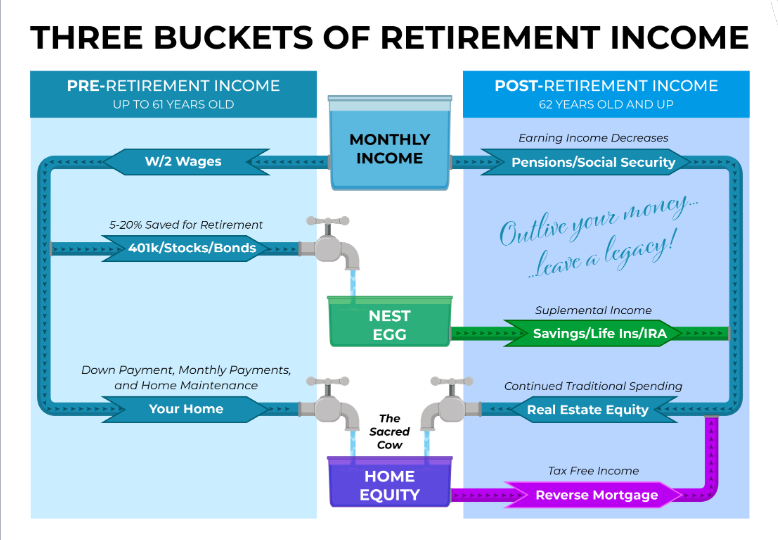

Retirement income can be broken down into three key buckets:

- Earnings (Bucket #1) – During your working years, this is your primary income source: wages, salaries, and self-employment earnings.

- Retirement Savings (Bucket #2) – This includes pensions, Social Security, 401(k)s, IRAs, and other investment accounts that provide income in retirement.

- Home Equity (Bucket #3) – This is the wealth accumulated in your home through mortgage payments and appreciation.

As retirement begins, most people transition from earning income (Bucket #1) to relying on savings and Social Security (Bucket #2). However, many retirees continue to neglect Bucket #3, leaving significant wealth trapped in home equity. Some even continue making mortgage payments when they don’t have to, unnecessarily reducing their liquid retirement funds.

A smarter approach is to strategically use home equity to enhance cash flow. With a reverse mortgage, you can convert your home equity into tax-free cash, providing an additional income stream without selling your home or depleting other retirement assets.

Optimizing Retirement Income with a Reverse Mortgage

By shifting your perspective on home equity, you can maximize your retirement income and increase the longevity of your savings. Research from Texas Tech University and Boston College’s Center for Retirement Research supports the strategy of incorporating home equity into retirement planning. Those who do so are often in a stronger financial position, with assets that last longer and provide greater flexibility.

Retirement operates under a different set of financial rules than your working years. Understanding these rules—especially regarding taxation, home equity, and long-term care planning—can make all the difference in securing a comfortable and stress-free retirement.

If you’d like to explore how leveraging home equity could improve your retirement strategy, we’re here to help. Contact us today to request more information.

Additional Resources: Pfeiffer, S., Ph.D., Salter, J., Ph.D., CFP®, AIFA®, & Evensky, H., CFP®, AIF®. (2013). Increasing the sustainable withdrawal rate using the standby reverse mortgage. Ellis, C. D., Munnell, A. H., & Eschtruth, A. D. (2014). Falling Short: The Coming Retirement Crisis and What to Do About It.